How Fractional Shares Can Help Investors - Syfe Trade Fees and Review

Investing in fractional shares can be useful for both new and experienced investors. For those who are just starting out and do not have a huge sum of capital to invest, fractional shares allow you to own the shares of a company when you cannot afford to pay full price for a stock. For experienced investors, fractional shares are useful in portfolio allocation, as it allows us to control the exact portfolio exposure that we want to have for certain stocks or even industries. With Syfe Trade, which calls itself Singapore's first neobroker, you can now invest in fractional shares in the US from as little as US$1.

I often get asked by readers who are new to investing and wish to purchase shares of companies like Facebook, Amazon or even Google for a start, but do not have enough to purchase even the minimum (1 share for US equities).

In Singapore, the minimum investment sum has been reduced from 1000 shares to 100 shares since 2015, whereas the minimum in HK depends on which stock you're buying (S$8000+ for Tencent at time of writing vs. S$2000 for Alibaba).

Most investors in the US do not face this issue as Robinhood - which is widely used there - offers fractional shares trading, but Singapore did not have this option until fairly recently.

What is a fractional share?

A fractional share is anything that is less than 1 share of a company.

They are not a new concept, albeit known as "odd lots" for those of you who have invested or received scrip dividends before. However, you cannot directly purchase fractional shares in any stock listed in the SGX, which means that if you wanted to buy DBS, you will need to pay a minimum of S$32 x 100 = $3,200 to own it.

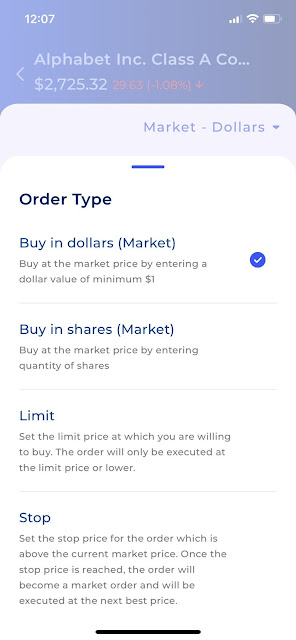

If you're using Tiger, Moomoo, FSMOne, POEMS, DBS Vickers or OCBC Securities, you will find that when you want to buy 1 share of any US stock e.g. Alphabet, you will need to pay at least US$2,800 (at time of writing).

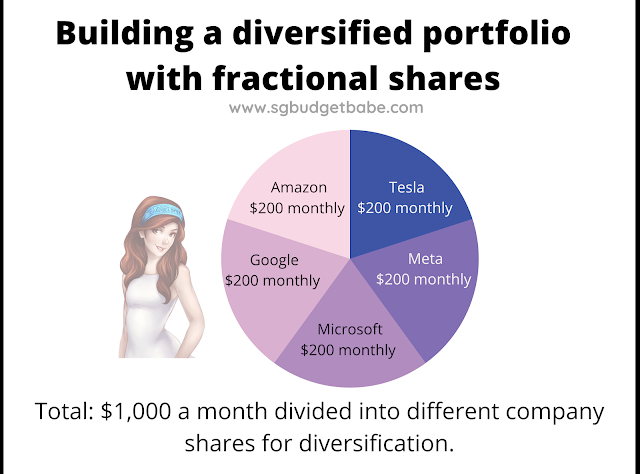

But what if you're starting with $10,000, and want to spread that out across 5 or different stocks rather than just having one position be more than 25% of your portfolio?

Try to recreate the portfolio I've shown as an example above, and you will quickly find that you have

- uneven allocations

- >70% exposure on just 3 positions alone (AMZN, GOOGL and TSLA)

- uninvested dollars left over

But if you use a brokerage that allows you to buy fractional shares - like Syfe Trade - you'll easily be able to control and craft your desired portfolio without the above issues.

What are the benefits of buying fractional shares?

Invest with as little as US$1.

Fractional shares are incredibly useful to younger or newer investors who may not have (or wish to commit) a lot of money to a stock.

This means that unlike investors of my era, you no longer have to wait until you've built up a capital base of at least several thousand dollars before you start investing. I started only after I had built up S$20,000, as fractional shares weren't available during then.

Get exposure to a stock that would otherwise have been too expensive for you to own.

You get the same percentage (%) returns regardless of your capital. Amazon is often used as an example, as its share price of more than US$3,000 is quite difficult for many young investors to buy. But with fractional shares, you no longer have to pay full price - instead, you get to pay what you can and get the corresponding fraction of the share.

If Amazon goes up by 10%, you'll also see your position go up by 10%.

Gone are the days where you've to restrict yourself to only companies with a lower share price (relatively speaking) because you had limited capital.

You can do dollar-cost averaging more efficiently.

Whether you wish to allocate US$10 or US$100 per month to all your favourite stocks, you can now do so accurately. This would have been impossible in the past when you had to factor in minimum lot size (which is still the case in Singapore and Hong Kong today - it is extremely difficult to do DCA into stocks like Tencent or BYD).

You can control your portfolio exposure and asset allocation.

Imagine that you wanted to set specific allocations to different industries or stock types in your portfolio, such as limit SaaS (software-as-a-service) companies in your portfolio to no more than 20% because you're concerned about the volatility in their share price especially as we move into 2022.

You still can't do that on any of the existing local brokerages, but with Syfe Trade, you now can.

What are the downsides to buying fractional shares?

The biggest drawback to fractional shares is that they are not always available in most brokerages. At the moment, only Interactive Brokers and Syfe Trade offer this to investors. Interactive Brokers targets the more savvy and advanced investors / traders, with more complex features such as options, margin trading, derivatives, etc.

You might also end up paying a lot more in transaction fees due to the temptation to invest in many different companies.

This is a common problem among new investors, who may end up being more reckless with their money since they can invest in almost any stock regardless of capital now.

To avoid these, you will need to be disciplined as an investor and calculate the cost of your moves either way.

Buying fractional shares with Syfe Trade

If you want to buy fractional shares, one of the easiest ways to do so would be through Syfe Trade when they launch on 18 January 2022.

For now, you can join their waitlist in order to get early access to the trading platform. What’s more, you may find yourself one of 10 lucky winners to walk away with an iPhone 13 when you join the waitlist! The draw closes on 17 January 2022 and you can view the waitlist contest details here.

Most of us are already familiar with Syfe, thanks to their innovative robo-advisory platform which has launched multiple solutions over the years, and recently gave DIY investors the flexibility to customize our own ETF portfolio.

But what's even more exciting is that Syfe has recently been approved to start offering brokerage services, and will soon be launching Syfe Trade. Syfe touts this as Singapore's first neo-broker, with the aim of making investing more accessible (and easier) for more people.

If you're unfamiliar with the term, neo-brokers essentially refer to a new class of brokerages that are democratising stock investing through lower fees and easy-to-use digital platforms. Robinhood is perhaps the best example, as they empowered retail investors to invest even with just $1 thanks to fractional shares. Otherwise, not every US investor would have been able to afford Tesla shares.

Designed as a simpler and more affordable way for retail investors to trade US stocks, Syfe Trade also comes with the following benefits:

As part of its introductory offer, you can get 5 commission-free trades per month, and just US$0.99 per trade after that.

From Q2 2022 onwards, you will still get 2 commission-free trades each month, with subsequent trades at US$1.49.

Aside from being the lowest among all the other brokerages in Singapore right now, what I like that Syfe has chosen to price its fees as a simple all-in fee, instead of charging separately for commission fee + a platform fee.

There are no custodian fees and also no dividend handling fees. If the stock you're invested in pays out dividends, your corresponding share of that dividend will be credited directly into your account.

Is Syfe Trade safe?

If you're concerned about security, you'll be glad to know that Syfe is regulated by the Monetary Authority of Singapore. Your US securities are custodised in individual accounts maintained with Syfe’s US broker-dealer, who is a member of the SIPC (Securities Investor Protection Corporation) in the United States. SIPC protects the securities customers of its members up to US$500,000 (including US$250,000 for claims for cash) in the event of brokerage failure.

When you transfer money into Syfe Trade to invest, your funds are held in a trust account with HSBC and are kept separate from Syfe's own accounts.

As someone who mostly curates individual stocks and ETFs for my own investment portfolio, I've always advocated that robo-advisors are a super-easy way for beginners to get started, while teaching readers who seek higher returns on how they can learn to select their own individual stocks.

Which is why I'm pleased that Syfe is doing this, and see it as a move in the right direction.

Sponsored Message by Syfe

Investors in Singapore looking to trade US-listed stocks and exchange-traded funds (ETFs) will soon have another option with Syfe Trade. What's more, you'll be able to trade fractional shares on Syfe Trade, which means you will no longer have to pay high commissions, fees, or big sums of money to invest in the world’s biggest companies.

You can earn more than S$200 in cash credits when you sign up, fund and execute your first trade, and refer your friends to Syfe Trade. This will be credited into your account as an increase in your buying power, which you can then use to buy any US stock or ETF of your choice. Full T&Cs here.Click here to register on the waitlist for Syfe Trade, and stand a chance to win an iPhone!

P.S. If you’ve previously registered for the waitlist and have been given early access, you can follow the steps here to create your Syfe Trade account. For existing Syfe users, the toggle function to get to Syfe Trade is within “Settings”.

Early access clients are also eligible for the Syfe Trade welcome promotion, so you don’t have to wait for the official launch to start trading.

Disclosure: I'm an existing user of Syfe, and was given early access to test out Syfe Trade in order to review it. This article was written in collaboration with Syfe. All opinions are that of my own.

Disclaimer: Not financial advice. Any form of investment carries risks, and none of the stocks mentioned in this article serves as a recommendation to buy (or sell). Your individual returns may vary depending on your own skill as an investor. Always do your own research before investing. This advertisement has not been reviewed by the Monetary Authority of Singapore.

7 Comments

hi BB,

ReplyDelete- do you fund your account in USD or SGD?

- what are their inhouse FX rates spread compared to the spot rates?

- any charges for deposit/withdrawal into their account?

-if one is already an exisiting syfe user, does the referal bonus also be applicable to the referee?

Heyhey!

Delete1. I fund my account in SGD via bank transfer, but you can also choose to fund in USD if you wish.

2. Syfe's inhouse FX rate spreads are pretty competitive. Check out this video where this Kelvin compared it to others: https://youtu.be/PW1RMhGPU9o

3. No. But if you withdraw in USD, bank charges apply. See this link: https://help.syfe.com/hc/en-us/articles/4414197128729-Are-there-bank-charges-fees-for-withdrawals-

4. No, as an existing user you'll only be entitled to the Syfe Trade welcome promo.

Just to take note, not all ETF and stock support fractional shares

ReplyDeleteDo you have a referral code to sign up Syfe?

ReplyDeleteI have a personal referral code, but use the generic one (BUDGETBABE) gets you better benefits !

DeleteBetter benefits with your referral code BUDGETBABE? Can you list out the benefits? I was trying to find out in your article but I think you didn't mention them.

ReplyDeletepromo code BUDGETBABE waives off your management fees for the first 3 months (up to your first $30,000) if you're going with any of their pre-selected robo portfolios. I also have a personal referral code but that gives you less savings (while I earn more in referral fees), so I'm more inclined to share the one that readers will save more with instead.

DeleteSyfe Trade doesn't have any promo code because you're already getting free trades etc when you sign up.