Buying A Property Soon? Here's how you can (legally) get around the latest cooling measures

The Singapore government has announced its latest round of cooling measures for the property market. Here's a quick summary, and how you can (legally) get around them.

What are the latest changes?

1. Higher ABSD (Additional Buyers' Stamp Duty)

If you're a Singaporean/PR buying your first property, you don't have to panic because there's no change for you.

However, if you're purchasing your second property, you will now have to pay higher taxes i.e.an increase of 5% for Singaporeans and 10% for PRs.

For foreigners and corporations buying residential property, they will now also have to pay 10% more in ABSD.

With the ABSD raised to 35% for housing developers, this now adds pressure to developers to complete and sell all units within the 5-year deadline. In the mid to longer term, it is also expected to slow down the sharp increase in land acquisition prices and tame the en bloc market.

2. Lower TDSR (Total Debt Servicing Ratio)

The TDSR has been reduced by 5%, which I do not see as a major change. In fact, this is even better as it will make buyers at the fringe think twice about leveraging too close to the limit, and exercise prudent buying in the immediate and long run.

But in fact, according to DBS, the current mortgage-to-income ratio is still relatively healthy and below the maximum threshold:

As a finance writer, I must also to tell you to be prudent with your debt anyway. If you were hovering near the 60% TDSR limit prior to these changes, then you should definitely relook your debt commitments and see what you can pare down or eliminate. Because the last thing you'd want is to find yourself in a situation where you're now struggling to repay your monthly debt obligations due to a higher-than-expected interest rate increase...

Also, remember that TDSR consists of more than just your mortgage - it also includes other debt obligations such as your car loan, credit cards, etc.

And for self-employed personnel or those operating a sole proprietorship, any debt commitments by your company - such as working capital loans or hire-purchases - will count towards your TDSR as well.

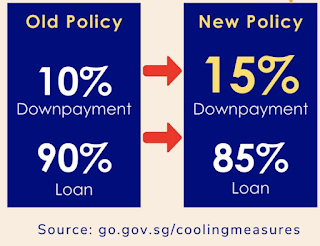

3. Reduced LTV (Loan-to-Value) limit for HDB loans

If you intend to take a HDB loan, bear in mind that you will now need to pay a higher deposit (5%) since the LTV limit has been reduced.

To be honest, this shouldn't be too big of an issue, and I'll elaborate on why in the next section where I talk about solutions.

There is no change to LTV for those on a bank loan.

Who's affected?

As you can see, the latest curbs are mainly targeted at individuals who are buyers purchasing a second (or third) home for investment, as well as foreigners purchasing private property, rather than residents seeking to purchase a place to live in.

It also targets buyers who are at the fringe i.e. servicing debts that run too close to the TDSR limit. This group is the most vulnerable to interest rate hikes, which are likely to come next year (as guided for by the Fed) and will drive debt repayment obligations upward.

Companies and housing developers are also affected.

How to (legally) "avoid" paying ABSD

But before you fret, don't worry because there are ways where you can still structure your property ownership so that you still have multiple properties in your household.

While tax evasion is illegal, tax avoidance is not. But those who are ignorant will continue paying taxes because they didn't know of alternative ways to structure their purchases such that they can pay less taxes.

Important Disclaimer: This is for information only and not a recommendation from me in any way. I do not know your specific financial or property ownership scenario nor plans, so none of these information below should be taken as individualized advice from me to you. Before you execute any of the moves below, please seek out a licensed professional real estate agent or property lawyer to advise and assist you accordingly. The information presented here is for reference and educational purposes only. I do not represent nor speak on behalf of any government agencies or statutory board(s), and definitely not for HDB, IRAS, CEA, URA, MND, etc, which is why you cannot take my words as a legal confirmation in any way. It is best that you engage a professional or get any confirmation that you want in legal black-and-white before you execute a move in order to protect yourself. I do NOT advocate breaking of any laws in Singapore when you're buying property, but I'm a firm believer that you should be educated on the prevailing policies and how best to structure your purchase and/or investment(s) in order to reduce your relevant taxes liable.

1. Decouple and buy under individual names

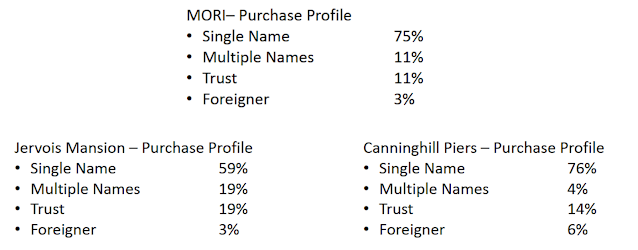

If you don't already know, many couples are using this method to skirt around ABSD requirements. Just look at the most common purchase profile for several new launches recently: | |

|

This is how it is usually executed:

- buy the first property under one spouse's name

- buy the second (private) property under the other spouse's name

Another method would be to buy under a 99-1 ownership scheme, which will result in the stamp duties being payable only on the 1% that is transferred (or sold to the 99% owner) later on. The savings on stamp duty here can easily be 5-digits or above, compared to paying on a 50% split being transferred.

The 1% owner can now be "freed up" to buy another property without having to incur high stamp duties on a second property purchase.

This method is fairly common in the private property market.

3. Buy under trust

Don't believe me? Here's one recent example:

If A purchases a residential property to be held on trust for the beneficial owner B, ABSD is charged based on the profile of the beneficial owner, B. - IRAS

You'll be better off selling your HDB first.

In this case, you can explore which of the methods above to avoid ABSD can work for you. Otherwise, you may want to rethink your plans and perhaps go for commercial, industry or even overseas properties instead if you really want to buy one for investment. Why limit yourself to just residential properties when they now incur so much tax?

Property remains an extremely resilient asset class in Singapore, especially if you look at the transaction trends over the past decades.

Here's what the Ministry of National Development has officially said:

If left unchecked, prices could run ahead of economic fundamentals, and raise the risk of a destabilising correction later on. Borrowers would also be vulnerable to a possible rise in interest rates in the coming years.

The Government has therefore decided to implement a set of measures to cool the private and public housing markets, to promote continued housing affordability.

Now, given that locals make up the majority of buyers, I doubt these cooling measures are unlikely to have a long-term impact.

ABSD is a wealth tax, so it will affect the wealthier buyers rather than the mass-market home purchasers. If you fall into the latter group, you really don't have to be too worried.

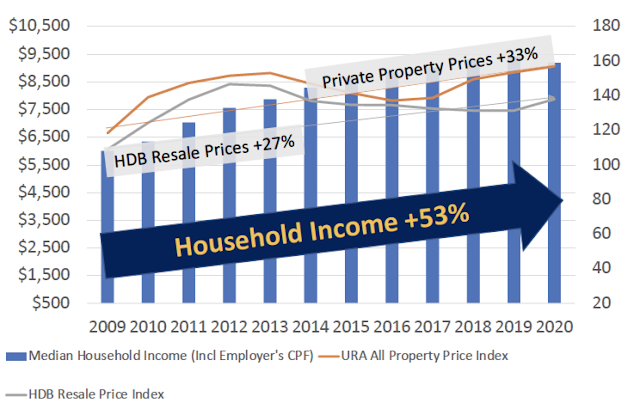

More importantly, the data shows that household income is still rising faster than property prices. And as a buyer, you should always make sure that you're not over-stretching your finances when you purchase a property (or multiple properties) anyway.

|

| Credits: Data provided by Senior Research Director of Huttons, Lee Sze Teck |

All in all, these measures aren't surprising considering how our government has been hinting at it for some time now. And given that the world is expecting multiple interest rate hikes next year, the TDSR changes are definitely prudent.

As for foreigners, even with the increased taxes, Singapore still remains an attractive place for them to invest (and safe, compared to other regional peers).

If anything, our government's decision to act at this time reaffirms that our property market is going up, up and up. These cooling measures will only serve as a temporary stop-gap measure to slow the rate of increase, rather than depressing prices for the long run.

So will property prices come down as a result of these measures?

I doubt so.

Huge thanks to my husband and property expert Nicholas Huang for assisting me with the data that I needed for this article.

P.S. For those of you who are still unsure about your next property move after this round of measures, my husband has agreed to help any of my readers who don't have a trusted advisor to guide them along.

He's willing to spare no more than 30 minutes of his time to review any plans that you have for the next 1 - 3 years. You can DM me on Instagram if you need help, so I can link you guys up.

With love,

Budget Babe

0 Comments