OCBC RoboInvest Review - a worthy contender with 36 portfolios to choose from

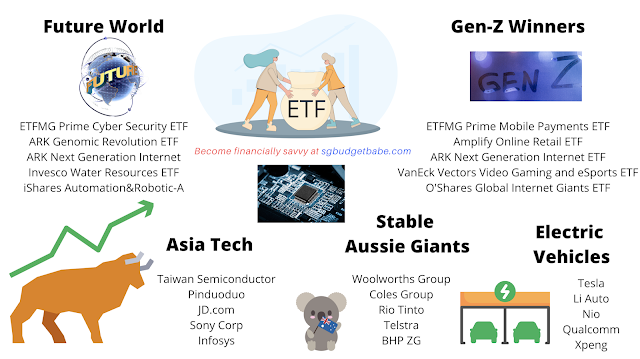

OCBC's RoboInvest is the most extensive robo-advisor in Singapore, with a total of 36 thematic portfolios across 6 markets. While most robo-advisors use ETFs in their portfolios, OCBC differs by including stocks that they have screened and curated to match the selected investment theme(s). Does having more variety spell good news for investors? I review it here.

As an active investor who prefers to have control over my own portfolio, I prefer robo-advisors that add value by helping me to save money (in the form of fees that I would have otherwise paid to the brokerages) while riding on growing themes or trends that I foresee will shape our world.

Which was why when OCBC reached out to showcase their RoboInvest solution, it certainly got me intrigued - mostly because it offers over 36 core and thematic portfolios which invests into stocks or ETFs, or both.

One of its more intriguing ETF portfolios, for instance, is the Gen-Z Winners portfolio, which is designed to provide diversified exposure to sectors that are likely to benefit from the spending of the Gen-Z generation. Right now, the portfolio rides on trends like online retail, mobile payments, next-generation internet and video-gaming, to name a few.

But while most robo-advisors already offer ETF portfolios, OCBC RoboInvest stands out as a game-changer for using stocks in theirs. One example would be that of the Asia Tech portfolio, which consists of stocks of Asian companies with significant business exposure to the IT sector in China, Japan, Taiwan and India.

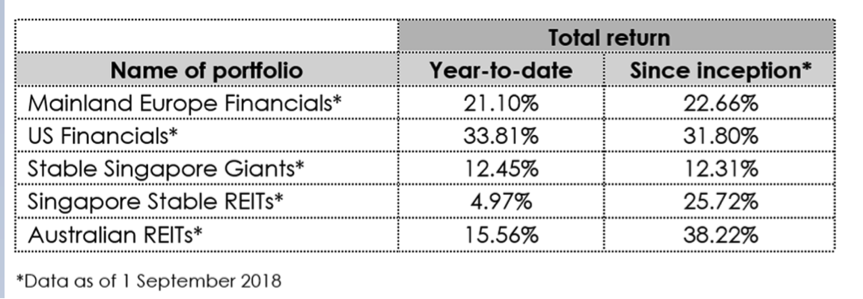

Another interesting portfolio that caught my eye was the Mainland Europe Healthcare portfolio, because I currently do not have any exposure to stocks listed in Europe. This portfolio consists of stocks with relatively lower volatility in the healthcare sector in France and Germany, which is likely to experience steady growth in demand for medical products and services, especially due to rising economic affluence and an ageing population.

There are 11 ETF portfolios and 25 Equities portfolios in total, with Electric Vehicles and Cyber Security being the latest additions to OCBC RoboInvest.

How are the stocks or ETFs chosen?

What methodology does OCBC use to determine whether a stock or ETF qualifies to be in their curated portfolios?

I asked the OCBC team this question, and while the algorithms used remain a trade secret, OCBC shared that over 60 quantitative factors across Quality, Value, Momentum, Growth and Volatility are being considered. For stocks, they highlighted that various factors are taken into account before a stock qualifies for inclusion into one of their curated portfolios. This includes screening for

- revenue growth

- return on invested capital (ROIC)

- profit margin

- earnings per share (EPS)

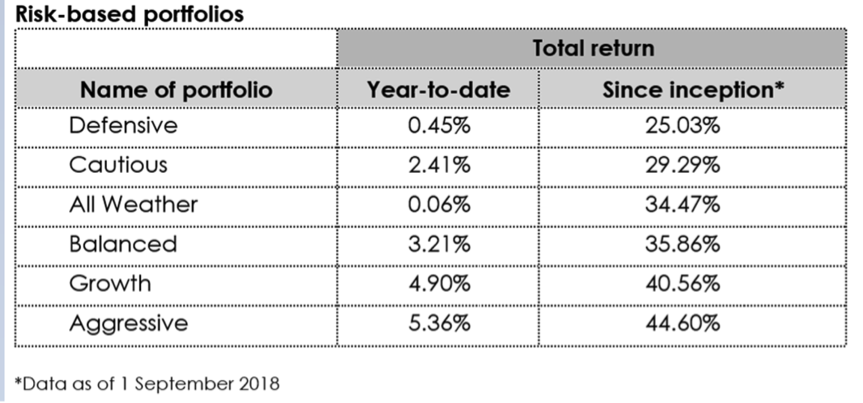

You can read about each of their 36 portfolios here, and if you prefer to not choose any theme(s), then you can also opt for one of their 6 core, risk-based portfolios instead - Defensive, Cautious, Balanced, All Weather, Growth or Aggressive.

The All Weather portfolio, for instance, is curated to be well diversified across fixed income, equities and gold. This should provide a balance between capital preservation and appreciation, while still growing your investments through various cycles of economic growth and inflation.

Following the traditional investment advice in books (where you should avoid paying more than 1% in fees), OCBC has capped its charges to 0.88% per annum on the total value of your investments held with OCBC RoboInvest.

In return, you get to save on transaction fees paid to your brokerage if you were to try and replicate the underlying holdings yourself, as well as the monthly amounts when you employ the dollar-cost averaging strategy of diligently adding new capital each month.

Rebalancing also does not incur any additional fees, compared to if you were to manually buy or sell the units yourself.

Whether you prefer to employ lump-sum investing or make regular monthly contributions for dollar-cost averaging, you get to choose and control how and when you want to invest.

You can invest from as low as US$100 without needing to open a securities or custodian account. Do note that some of the portfolios have specified minimum sums before you can invest in them, such as US$100 for Future World Portfolio or US$3,500 for the Dogs of the Dow Portfolio.

You can also opt for a monthly investment plan option to automate your capital injections, if you like. And since there is no lock-in period, you can make withdrawals without any charges at anytime you choose.

If examining the historical performance gives you greater assurance, then you can also review the top performers in each month to decide whether you'll like to allocate more of your capital, or liquidate them and channel into a different portfolio.

Even though I've been an OCBC customer for years and previously used their securities platform for buying and selling stocks in Singapore. I never knew they had a robo-investment option until now. It is exciting that the bank has added a robo advisor for their clients who want to grow their wealth, and is working with WeInvest as the platform operator to power its RoboInvest offering.

With more retail investors choosing to invest through robos, OCBC's RoboInvest truly stands out for its wide variety of portfolios. This is definitely suitable for investors who may feel restricted in having to chooseg between the (often less than 10) limited portfolios offered by other platforms in today's market.

This is also a much more convenient solution for those of you who have an OCBC account, since you can invest directly using your funds with the bank, instead of having to make a transfer separately.

What's more, you can easily get exposure to overseas markets without worrying about custodian fees through their solution that are normally charged by the local banks otherwise.

Definitely worth checking out, whether you're looking for investment ideas or a solution to help you invest better and more easily.

You will need to fill an e-form with your details here.

Sponsored Message

When you invest in OCBC RoboInvest, you can be rest assured that you are investing with a trusted financial institution recognised for its stability and wealth management expertise.

Choose from 36 different portfolios in RoboInvest and invest today via the OCBC Digital app, where you'll also get investment ideas and market insights from our OCBC investment experts, while being able to track and manage your portfolio easily on the go!

For more details, check us out at OCBC RoboInvest here.

Disclaimers:

Important Information

This advertisement has not been reviewed by the Monetary Authority of Singapore.

1. Any opinions or views of third parties expressed in this document are those of the third parties identified, and do not represent views of Oversea-Chinese Banking Corporation Limited (“OCBC Bank”, “us”, “we” or “our”).

2. This information is intended for general circulation and / or discussion purposes only. It does not consider the specific investment objectives, financial situation or needs of any particular person.

3. Before you make an investment, please seek advice from your Relationship Manager regarding the suitability of any investment product taking into account your specific investment objectives, financial situation or particular needs.

4. If you choose not to do so, you should consider if the investment product is suitable for you, and conduct your own assessments and due diligence on the investment product.

5. We are not making an offer, solicit to buy or sell or subscribe for any security or financial instrument, enter into any transaction or participate in any trading or investment strategy with you through this document. Nothing in this document shall be deemed as an offer or solicitation to buy or sell or subscribe for any security or financial instrument or to enter into any transaction or to participate in any particular trading or investment strategy.

6. No representation or warranty whatsoever in respect of any information provided herein is given by OCBC Bank and it should not be relied upon as such. OCBC Bank does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice.

7. OCBC Bank shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly howsoever in connection with or as a result of any person acting on any information provided herein.

8. Investments are subject to investment risks, including the possible loss of the principal amount invested. The information provided herein may contain projections or other forward-looking statements regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures, predictions or projections are not necessarily indicative of future or likely performance.

9. Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

10. The information in and contents of this document may not be reproduced or disseminated in whole or in part without the Bank’s written consent.

11. OCBC Bank, its related companies, and their respective directors and/or employees (collectively “Related Persons”) may, or might have in the future, interests in the investment products or the issuers mentioned herein. Such interests include effecting transactions in such investment products, and providing broking, investment banking and other financial services to such issuers. OCBC Bank and its Related Persons may also be related to, and receive fees from, providers of such investment products.

12. You must read the Offer Document/Indicative Term Sheet/Product Highlight Sheet before deciding whether or not to purchase the investment product, copies of which may be obtained from your relationship manager.

13. Any hyperlink to any third party article, or other website or webpage (including any websites or webpages owned, operated and maintained by third parties) is for informational purposes only and for your convenience only and is not an endorsement or verification of any such article, website or webpage by OCBC Bank and should only be accessed at your own risk. OCBC Bank does not review the contents of any such articles, website or webpage, and shall not be liable to any person for the same.

14. There are links or hyperlinks which link you to websites of other third parties (the “Third Parties”). OCBC Bank hereby disclaims liability for any information, materials, products or services posted or offered on the website of the Third Parties.

Collective Investment Schemes

1. A copy of the prospectus of each fund is available and may be obtained from the fund manager or any of its approved distributors. Potential investors should read the prospectus for details on the relevant fund before deciding whether to subscribe for, or purchase units in the fund.

2. The value of the units in the funds and the income accruing to the units, if any, may fall or rise. Please refer to the prospectus of the relevant fund for the name of the fund manager and the investment objectives of the fund.

3. Investment involves risks. Past performance figures do not reflect future performance.

4. Any reference to a company, financial product or asset class is used for illustrative purposes and does not represent our recommendation in any way.

For funds that are listed on an approved exchange, investors cannot redeem their units of those funds with the manager, or may only redeem units with the manager under certain specified conditions. The listing of the units of those funds on any approved exchange does not guarantee a liquid market for the units.

0 Comments