Why DBS Multiplier Might Be The Best Account For Families

Despite the competition, DBS Multiplier remains as a must-have savings account. With its latest revamp, Multiplier might just be the best account in the market, especially for families. Here's why.

My entire family has accounts with DBS and/or POSB. And as a couple, I can tell you that DBS Multiplier has been an absolutely amazing account for us, especially after we started using the joint account hack to have a single salary credit qualify for both of us to get bonus interest on our respective accounts. Read on the strategy we used here.

Upon becoming parents, we've had to open a Child Development Account (CDA) for each of our kids; POSB was the best choice both in 2018 and 2021 (the years when they were born). I also appreciated the convenience of being able to manage our kids' accounts and deposits on their behalf, especially within a single login.

So when DBS announced their latest changes to the Multiplier account, I had to pay attention because it would affect all of us.

In a nutshell, here's what has changed:

I'll zoom into a few that I feel are particularly worth highlighting.Using SGFinDex (instead of crediting your income)

If you're in a situation where you're either

- unemployed, or

- you don't get a fixed, monthly salary for crediting, or

- in a situation where your HR refuses to process a change of bank accounts for you to DBS, or

- your dividends are credited elsewhere

Well, there's still a way out as DBS has opened up a third alternative - simply connect your finances via SGFinDex to qualify.

For those unfamiliar with SGFinDex, it stands for Singapore Financial Data Exchange, and is an initiative by MAS which now allows consumers to access their financial information held across different government services (IRAS, CPF, HDB) and financial institutions.

This means almost anyone - if not everyone - can now easily meet the Income category requirement. In fact, I’d argue that this is a better move than the addition of dividends (from previous rounds of Multiplier upgrades), because actively syncing with SGFinDex for a holistic view of one’s finances will likely prompt more DBS customers to get in control of their financial planning (rather than just depositing their salary/dividends and forgetting about it).

More insurance and investment options

With more consumers taking up insurance and investments with the bank, DBS has since expanded Multiplier to recognise more insurance and investment options. But these 2 are worth highlighting: single-premium insurance policies and digiPortfolio.

In the past, only insurance premiums that were paid via cash would qualify for bonus interest. Now, even payments via SRS will also qualify.

As for investments, we financial bloggers and several retail investors have been asking DBS to include digiPortfolio transactions, so I was pleased to see that DBS has taken our feedback seriously. Or, if you're using your CPF or SRS funds to invest in unit trusts, that will now also qualify.

Having more options within the bank's products is always a good thing. If you're impacted by the latest changes, check out DBS' newest calculator here to see how much more interest you can earn now.

Why Multiplier is the best for parents

As the Chief Financial Officer for my household, I value the convenience of being able to manage everyone's accounts within a single bank.

Of course, it helps that POSB pays the highest interest for our children's CDA as well.

|

| Interest rates accurate as of October 2021 |

Having welcomed our second child just a few months ago, I had to relook our household expenses (in the joint account I share with my husband) and also our kids' savings accounts, since that's where I'll be (i) depositing all of their angpao money each year and (i) I'll be using their funds to invest on their behalf.

As part of our financial planning, I had to:

- recalculate our household expenses (to cater for higher bills from now)

- increase insurance coverage for both my husband and I (since Finn = an additional dependant)

- think about how I'd want to invest Finn's money from the Baby Bonus for him

Since Multiplier recognises transactions across ALL accounts (both sole and jointly owned) you have with the bank, this means that even eligible transactions made on other accounts with you will count towards your qualifying categories as well for bonus interest. For instance, if you're using your child's joint account to pay for premiums on CancerCare or Term Protect, this will still count towards the Insurance category for you if you're the policyholder. Or, if your joint account with your spouse is being used to repay your DBS housing loan where you and your spouse are joint borrowers, the transaction will count for both of you as well.

Check out my previous article here on how DBS NAV Planner can help you to improve your financial planning for your retirement and/or children's education, as well as how it can help beginners to potentially invest better.

Combine both your salaries for higher rates

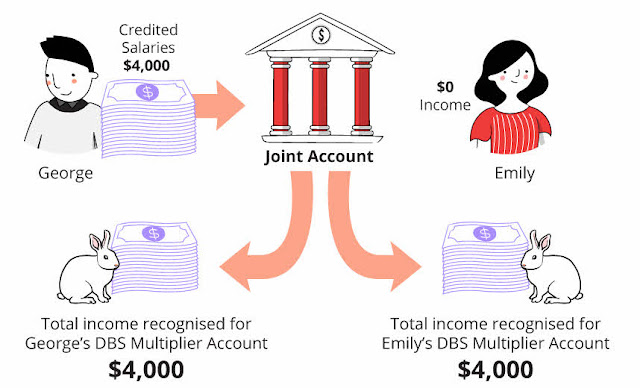

Although this isn't a new feature, this is a nifty hack if you have existing joint accounts with DBS. If you're a couple, you have an additional advantage: double up to earn even more bonus interest!

Credit both your salaries into a joint account and transact from there, and it'll be recognised as transactions for each of you.

With DBS' latest change, if a couple credits both their salaries into a joint account and transact from there, it will now jointly be recognised as higher transactions for each of you.

This graphic explains it best:

Even if one of you can't credit your salary or dividends, you can still use this joint account hack!

In this way, couples can still fulfil the requirements for higher, bonus interest even if one spouse is unable to credit their salary...and still be able to contribute to a decent monthly transaction amount.

Couples who prefer having a joint account for your shared household expenses will appreciate DBS Multiplier for this, especially given the fact that there is no other bank in Singapore right now that will reward you for having a joint account!

Disclosure: This post is written in collaboration with DBS.

0 Comments