Here's What You Can Save With NTUC's 60th Birthday!

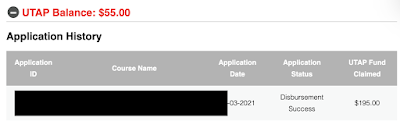

I've been an NTUC Member for several years now, and have benefited from the various benefits and offers that come with it. For instance, within 2021 alone, I've already received over $100+ of FairPrice rebates which effectively reduced our grocery bills, earned LinkPoints on my son's monthly childcare fees and even used $195 of my UTAP credits this year to offset a certification exam that I went for.

If you're a millennial or a parent like me, you're likely to find the membership perks and support schemes useful as well. From a personal finance standpoint, aside from helping you to save an incredible amount of money in a year, you can also benefit from low-cost insurance and investments to grow your wealth.

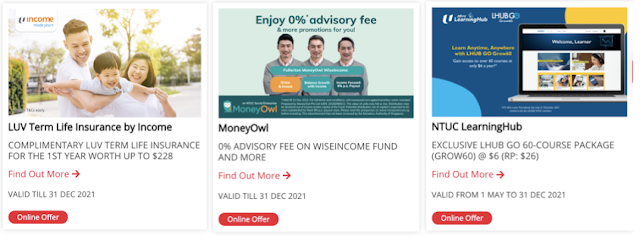

Insurance: Complimentary $50,000 Basic Coverage

For instance, if you need to top up your insurance protection but have limited cash, you can sign up for NTUC Income's term life insurance, exclusively for NTUC Members. Underwritten by Income, the policy offers complimentary $50,000 LUV Basic coverage for the 1st year. What’s more, receive $25 daily hospital cash benefit in the event of hospitalisation (even if you're admitted for COVID-19) and you can also enhance your coverage further with LUV Deluxe cover to cover 30 critical illnesses - when we top up $10 per month in our case (we're in our 30s). See terms and conditions here.

Investments: Reduced advisory fees on diversified portfolios

- FairPrice Online: if you generally shop at FairPrice like I do for LinkPoints, then you can now get a further $12 off your first online order (and earn LinkPoints online from 1 August onwards) as an NTUC Member. Don’t forget that you can also get 8% off in your birthday month when you spend at least $120 online.

- Shopee: if you’re shopping for new electronics, be sure to take $15 off with a minimum spend of $120. Otherwise, existing Shopee users can still get $6 off.

- Bubble tea: get discounts of up to 15% off bubble tea, which includes brands like Chun Yang Tea and Gong Cha.

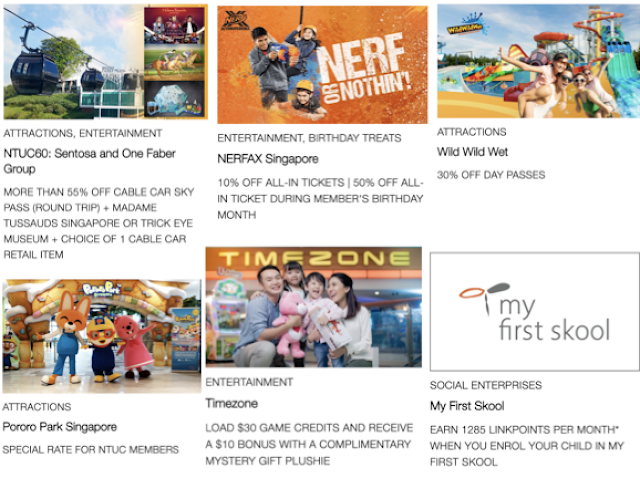

- Entertainment: as cinemas reopen, you can purchase discounted $9.50 movie tickets for Shaw Theatres at NTUC Members' Hub and indulge in your favourite cinematic movie viewing experiences again!

If you're not an NTUC member yet, then you're seriously missing out! Get a Ginnie Beanie worth $108* when you join me as an NTUC member here today!

Disclaimers:

All opinions expressed in this article are solely those of my own and do not reflect the opinions of NTUC Income Insurance Co-operative Limited (“Income”) or any of the other brands featured here.

The information contained in this article are provided and meant for general information only and do not constitute an offer, recommendation, solicitation or advice by Income or SG Budget Babe to buy or sell any product(s) or investment product(s). It is not and should not be relied as a financial advice and has no regards to any person’s investment and financial needs. If you are unsure whether this plan is suitable for you, you may seek personalised financial advice from a qualified insurance advisor. Otherwise, you may end up buying a plan that does not meet your expectations or needs. As a result, you may not be able to afford the premiums or get the insurance protection you want. Precise terms, conditions and exclusions of product are found in the policy contract. For customised advice to suit your specific needs, consult an Income insurance advisor.

Protected up to specified limits by SDIC. Information is correct as at 8 July 2021.

0 Comments