Singlife’s Grow is a digital ILP, but is it worth your while?

If you have friends or family who are starting out their investing journey and are feeling overwhelmed, this could be a good alternative to consider. (But if you’re a savvy or a seasoned DIY investor, ILPs may not be up your alley.) Here’s how Singlife’s digital investment-linked policy (ILP) is challenging traditional ILPs. Read on to understand more before you commit to one.

Existing Singlife Account customers may have noticed the launch of Singlife's latest product - Grow. While there's currently a waitlist to apply for a Singlife Account, I've been receiving several messages from readers on whether Grow is worth looking into, so let's investigate that today.

But first,

The problem with traditional ILPs in Singapore

(Skip this section if you're already familiar with traditional ILPs)

For those who are confused by ILPs and what they are, here's a quick summary: ILPs are policies offered by insurers that have both insurance coverage and investment opportunities. Usually, a portion of the premiums will be used to pay for distribution and other administration costs. The remaining premiums are then allocated for purchasing units in the sub-funds of the ILP that you get to choose (usually at the recommendation of your financial advisor), while some units purchased are then sold to pay for insurance charges and other fees.

As a result, ILPs haven’t exactly had the best rep in Singapore, given that not 100% of your premiums go towards investing, and some are used to cover costs (which might include your agent’s sizeable commissions). Furthermore, the cost of insurance generally rise as you get older, which means it is highly likely that with most ILPs, more units will need to be sold off from your ILPs to cover mortality charges.

|

| Source credits |

I speak from personal experience, as many insurance agents I encountered in Singapore tend to present ILPs as the first few plans they recommend to consumers (which I suspect might be due to the high commission structure). Personally, we financial bloggers generally consider this lousy advice because it mainly benefits the agent's pocket (from commissions) but not the consumer. Moreover, for customers who are looking to ILPs for comprehensive insurance coverage, ILPs offer poor value for the level of protection you get.

As the saying goes, you'd be much better off with Buy Term Invest the Rest (BTIR) i.e. buying a term life protection plan instead and invest the rest of your premiums elsewhere in a lower-cost investment plan or tool. The problem is that some customers buy term protection...but end up not investing the rest at all.

What more, while returns have never been guaranteed, it hasn’t stopped the agents I’ve encountered from talking up the projected returns of traditional ILPs. What is NOT mentioned are that these returns are prior to deduction of costs! No wonder many consumers are eventually left disappointed, because they were sold sky-high expectations but yet received less-than-expected returns.

There was an additional challenge - while these traditional ILPs did offer you the advantage of being able to invest into certain funds otherwise not accessible to the general public, you needed to select or switch between your choice of funds. Not the best choice since these ILPs were generally sold to consumers who weren't exactly investment-savvy, so many ended up relying on the advice of their insurance agent. Unfortunately, while many insurance agents are fantastic salespeople and protection experts, not all were necessarily great investors themselves.

I speak from personal experience, because one of the highly-recommended ILP sub-funds that my then-agent suggested to me back then was the Fortress Fund A. Those of you who bought ILPs in the early 2010s may remember this, because it was known as THE go-to ILP sub-fund with the following characteristics:

- Outperformance vs. the STI ETF since 2006

- A hefty bid-offer spread

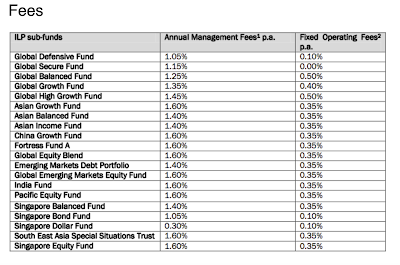

- 1.6^ management fees, on top of other charges

|

Some of the ILP sub-funds my agent got me to look at back then. My portfolio then included Fortress Fund A too, at my agent's recommendation. |

|

The fees schedule, as provided by my agent who sold me the ILP back then

There's a really good write-up that Money Maverick did here about the rise and fall of this fund, which was often used then by agents as a defence against critics who slammed them for selling ILPs, because even though the fees for this fund were so high, there was no denying that their client returns were outperforming most DIY investors, and most certainly local index investors.

Until it was no longer.

From 2017 onwards (a few years after I terminated my ILP and investment in this fund), the fund's performance started to wane, and by 2019, "any Fortress Fund A investor who was previously making a lot more money than the naysayers for years...had completely lost their advantage" (Money Maverick, December 2020)

Therein lies the problem of traditional ILPs:

- Extremely high costs (mine worked out to be more than 30%, so I cancelled it because even if it performed at 4% p.a. I would get back LESS than my capital due to the costs incurred)

- Consumers still need to choose which ILP sub-funds to invest in. Many non-savvy folks ended up relying on the advice of their agents, which didn't always result in a happy ending. (Lucky you if yours did!) The Fortress Fund A isn't the only sad story.

- Rising cost of insurance as they get older.

What about now? Over the years, more investment-focused ILPs have been launched as a response by several insurers to counter the last point (rising cost of insurance). But costs remain high nonetheless and there are still penalty fees if you make a withdrawal or surrender early.

Singlife’s Grow is a digital ILP, but is it worthwhile for you?

Singlife recently launched Grow as an alternative, digital ILP with the following premise to address the common issues associated with most ILPs today:

- 100% of your premiums are invested from Day 1

- No cost of insurance for your base benefits. By reducing the insurance component to a minimum, Singlife Grow is thus not designed to provide high coverage in your protection portfolio. I thus see this as a more "modern" type of ILP with no insurance charges.

- Lower costs compared to other ILPs today, especially given how Singlife has reduced the costs and eliminated agent commission fees. With management fees at 0.25% of your account value per quarter i.e. approximately 1% per annum, that's lesser than what most other ILPs charge.

- No lock-in period, nor withdrawal or surrender charges. Unlike traditional ILPs, you have the flexibility to make a withdrawal when you need the money at no costs, with up to 95% partial withdrawal allowed as long as your account value still has a minimum of S$1,000 remaining.

- Professionally managed by Aberdeen Standard Investments, so that you don't have to choose your own sub-funds by yourself. You’ll only need to decide between 3 portfolios of different risk levels that have been constructed for you.

- Dividends are reinvested for you, unlike when you DIY.

Is it the lowest-cost approach?

No, but it is among the lowest for ILPs. What's more, the 3 portfolios offered are actively managed by their investment expert partners from Aberdeen Standard Investments, at a fraction of what active fund management advice would usually cost you.

Costs are only marginally higher vs. if you invest directly by yourself, considering how you’re paying for an actual fund manager to manage your sub-funds.

Plus, regardless of market conditions, if the life assured dies during the period of cover, Singlife will still pay the death benefit. (You can read more about this on their website as well.)

Is it cheaper than DIY or investing through robo-advisors? No, but remember that this isn't the competition as Singlife Grow is designed for consumers who do not feel that the DIY approach or robo-advisory algorithms work for them. Singlife’s Grow is prioritizing human expertise and active management over algorithms, so if that's a sentiment that you share, then you might want to take a closer look.

Who is Singlife’s Grow suitable for?

If you're savvy and know how to DIY, or if you know how to do your own portfolio allocation and switching (e.g. given the options offered by the various robo-advisors), then this is unlikely to be suitable for you.

However, if you're new and do not have much mind space (nor the time nor effort) to invest, this could be a potential avenue. After all, Grow was launched to provide diversified investment opportunities beyond what is offered in the Singlife Account to consumers.

Minimum investment amount: S$1,000

The minimum you'll need to invest is a S$1,000 initial single premium.

You can also set up a monthly investment via recurring single premium from as low as S$100 to enjoy the benefit of regular investing.

Otherwise, you may also perform an ad-hoc top-up anytime with a minimum of S$100.

What's in Singlife’s Grow's investment portfolio(s)?

The 3 portfolios that have been designed and will be professionally managed by Aberdeen Standard Investments (ASI) are:

For context, Aberdeen Standard Investments is a global asset manager dedicated to creating long-term value for our clients. They manage US$562.9bn of assets on behalf of governments, pension funds, insurers, companies, charities, foundations and individuals across 80 countries (as at 30 June 2020).

In case you're also wondering about the insurance component, in the event of death or terminal illness, your loved ones will receive the higher of either 101% of your Net Premiums or your Account Value. Here's an illustration:

Please note that Singlife’s Grow is NOT designed to be used as your base (or main) life insurance protection. If protection is what you need, Singlife offers other life insurance policies with better value on your premiums paid for pure protection (such as their cancer insurance here).

Sample Potential Customer Profile

Based on my discussions with the Singlife team, I concluded that this would be more suitable for young working adults or business owners who are new to investing:

- Your focus is primarily on your career or business at the moment, or perhaps you even have to juggle young children at the same time, leaving you with very little time or energy to learn and manage your own investments.

- You've already checked out robo-advisors, but you still find it too complex as to which portfolio offering to go for (e.g. equities, REITs or bonds? or all? in what allocation?).

- You've considered the ILPs that your insurance agent recommended you, but you're still unsure whether the high costs are justified given the illustrated potential returns, and you're also doubtful if the projected returns can really be achieved.

- You rather not go through the banks or insurers, given that the fees (e.g. for sales charges of unit trusts) can be as high as 5%, and some may require you to commit a fixed, regular capital each month. You want a one-time effort to invest your bonus / angpao money / spare cash instead, without having to commit to regular capital injections thereafter.

- You're a low risk-taker when it comes to your spare cash savings, and would like the option of a conservative investment portfolio available within Grow.

- You prefer to have your portfolio managed by active fund managers, but do not have the minimum quantum sum required and you prefer an option for lower fees still.

CONCLUSION

I've mentioned it before and I'll say it again, while I personally chose to cancel my ILP for reasons detailed previously, I do acknowledge that ILPs can still serve a small, niche market for folks who need a bit more hand-holding when it comes to their investments, albeit at a higher cost than if you DIY.

For instance, do you know how to pick the better-performing equity funds within the universe of funds? How often should you rebalance your investment portfolio? If you still struggle with these questions, then perhaps you might not be ready to go fully DIY just yet.

So, don't reject ILPs just because you read that Budget Babe decided to DIY her own investments. Instead, you should be reading up on the different perspectives, and before you commit to an ILP, make sure you know the pros and cons of each.

Everyone starts off at a different stage of their personal finance journey, and there are many ways to get to the end goal of financial freedom. If DIY investing is not your preference (maybe earning a higher income / growing your business is your strength instead), then Singlife's Grow could be one alternative for you to "park and forget" while letting others manage your money for you.

And perhaps one day when you've armed yourself with enough knowledge and skills to eventually invest directly by yourself into the markets instead, we'll all celebrate together with you.

I’ve tried to provide as much information as I can on Grow here, but if you’re keen to check them out, I highly recommend that you head over to Singlife’s website HERE to read more.

Sponsored Message:

Singlife has been known for the Singlife Account, an insurance savings plan launched in 2020. Just a step beyond the Singlife Account, Grow is yet another way it’s delivering on this with a simple and direct way to invest and help people potentially get more out of their savings.

Disclosure: This is a sponsored post brought to you in collaboration with Singlife. While I personally do not invest via ILPs, I have friends who do, and so I hope this educational article will help you to understand why some may be suitable or keen on Singlife Grow. While I hope that everyone can eventually "graduate" from ILPs and do their own direct investments, ILPs can still be suitable as "baby steps" in your investment journey until you feel ready enough.

Disclaimers:

The views and opinions in this article are those of the author and do not represent or reflect the views of Singlife.

The information is meant for your general knowledge and does not regard any specific investment objectives, financial situations or particular needs any person might have and should not be relied upon as the provision of financial advice.

Singlife’s Grow is an Investment-Linked Policy (ILP) which invest in the respective ILP sub-funds within your chosen portfolio. Investment products are subject to investment risks including the possible loss of the principal amount invested. The portfolio performance is not guaranteed and the value of the units and the income accruing to the units (if any) may fall or rise. Past performance is not necessarily indicative of future performance. A product summary, terms and conditions and fact sheet relating to Singlife’s Grow are available. You should read the product summary, terms and conditions and fact sheet before making a commitment to purchase.

Singlife’s Grow is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Singlife or visit the LIA or SDIC websites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Protected up to specified limits by SDIC.

Information is correct as of 20 February 2021.

0 Comments